Motor Insurance

Vehicle insurance or motor insurance is meant for cars, two wheelers and other road vehicles. A motor package policy protects the insured vehicle against the damages vehicle insurance also provides the mandatory coverage for third-party liabilities.

Process and documents for

Hypothecation

-

Motor insurance is an insurance policy that covers the policyholder in case of financial losses – resulting from an accident or other damages – sustained by the insured vehicle.

A comprehensive motor insurance policy covers damages to third-party and third-party property along with compensating for own losses as well.

-

Third-party Vehicle Insurance Policy The Third-party Liability Policy is also referred to as Third-party Plan, Liability-only Policy, and Third-party Cover. The Third-party Vehicle Insurance Policy is a basic plan and is mandatory as per The Motor Vehicles Act. Not owning this basic vehicle insurance plan while driving/riding in India can lead to heavy monetary penalties. The Third-party Policy covers the vehicle owner’s liabilities in case the insured vehicle injures a third party or damages their property. The price of such policies is regulated by IRDAI and is based on the cubic capacity of the vehicle's engine. It is noteworthy that the third-party plan does not offer motor insurance coverage for damages to the insured vehicle

-

Comprehensive Vehicle Insurance Policy The Comprehensive Vehicle Insurance Policy includes the benefits of a Third-party Vehicle Insurance Policy as well as covers damages to your vehicle in case of an accident, fire, riots, mand-made and natural calamities. The policy also covers vehicle theft. Buying a Comprehensive policy also opens up avenues to purchase add-ons for extra coverage. Since the Comprehensive policy offers enhanced coverage, it costs more than the Third-party policy. Also, if you choose any of the add-ons, it will lead to a proportionate increase in the payable premium. Thus, you must choose only suitable add-ons. Motor insurance companies decide the price of the Comprehensive Vehicle Insurance Policy in India. Hence, prices can vary from insurer to insurer.

-

Private car insurance policy The Comprehensive private policy insures your personal or private cars against damages or losses arising from accidents or other mishaps. The cost of private car insurance depends on the make and model of the car. The private car insurance policy is classified into a Third-party Liability Plan only or a Third-party Liability Plan and Own Damage cover package. With this type of motor insurance policy, you get benefits such as. Cashless claims Damage or loss protection (accidents, fire/explosion, theft, natural and man-made disasters) Unlimited liability cover for third-party injuries and death claims Liability cover for third-party property damage Pickup and drop facilities for repairs at select cities Personal accident cover

Commercial vehicle insurance Jump Tag Icon Vehicles used for commercial purposes and not for personal or private use are classified under commercial vehicle insurance. Buses, trucks, taxis/cabs, light and heavy commercial vehicles, multi-utility vehicles, ambulances, agricultural vehicles, auto-rickshaws, rental cars and bikes, etc., are some of the vehicles covered under commercial motor insurance. Here are the benefits of Comprehensive commercial motor insurance. Cashless claims Damage or loss protection (accidents, fire/explosion, theft, natural and man-made disasters) Unlimited liability cover for third-party injuries and death claims Liability cover for third-party property damage Personal accident cover The cost of commercial vehicle insurance might be slightly higher than private vehicle insurance since they are considered higher risk than personal vehicles.

-

Motor Insurance As per Section 146 of Motor Vehicles Act 1988 No person can drive a vehicle without proper insurance, which reads as under: Necessity for insurance against third party risk. — (1) No person shall use, except as a passenger, or cause or allow any other person to use, a motor vehicle in a public place, unless there is in force in relation to the use of the vehicle by that person or that other person a policy of insurance complying with the requirements of this Chapter: [1][Provided that in the case of a vehicle carrying, or meant to carry, dangerous or hazardous goods, there shall also be a policy of insurance under the Public Liability Insurance Act, 1991 (6 of 1991).]

Vehicle renewals online

-

Proposed Solution

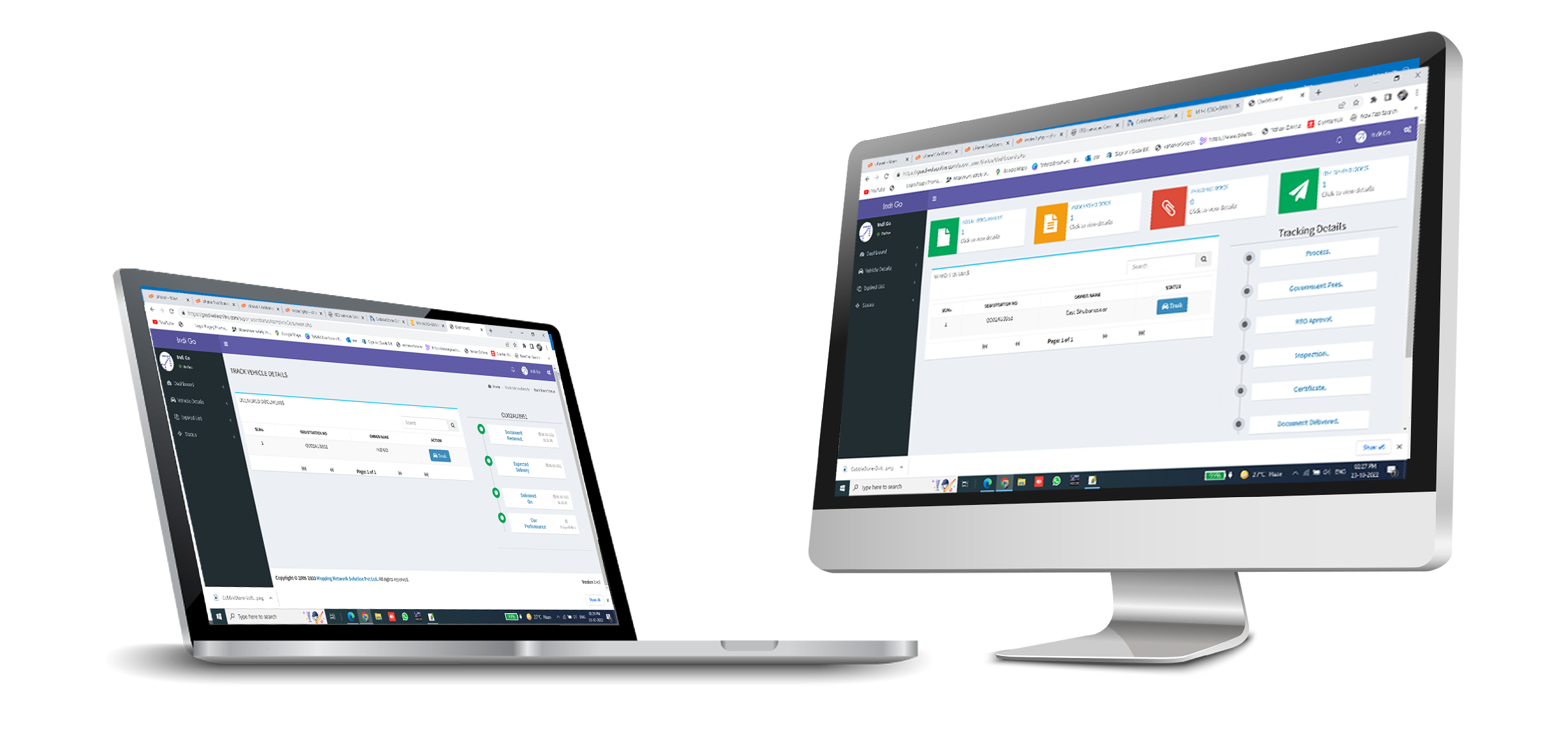

We have introduced vehicle documents renewal online. Vehicle owners can opt for online/door step services for vehicle documents renewal

BenefitsOnline dashboard for easy access of all the documents at one place.

Central login system to access branch-wise documents and vehicle document status.

Account manager for each fleet owner for one-to-one assistance.

Services Renewals of Fitness and Peímit

Dashboard

Our experts combined the elements of technology and experience together to make your work easy, swift And care-free.

-

Fleet DashboardFree web and android based application to helping fleet owners to keep their vehicle documents online and Get online access to see and download vehicle document on your computer or smartphone anywhere and anytime. even get statutory due date alerts. like Fitness, Permit, Road tax, Pollution, and Insurance.

-

Real-time status RTO applied filesIt's easy to navigate and much user-friendly. It's available in web and android in a single click, you can go through your entire RTO applied files status.

Received files: It indicates how many files you have given to the service provider for applying for vehicle fitness or other services.

Process: it indicates the real-time status of the process, such as document received date & time, govt fees, RTO passing,Certification and Document Delivery.

Pending: It indicates the pending status of the documents.

Delivered: It indicates the entire performance of the service provider.